Technology is an enabler. Previously organizations allowed staff members in specific departments to work remotely with great success thanks to technology. When the pandemic gave organizations no choice, they enabled all staff to work remotely, and the trend has stuck. For occupations that remain entrenched in time-honored methods, such as finance, manual methods left them scrambling to adapt. The evidence that mounts in favor of accounts payable automation, now more than ever, is impossible to ignore.

Even if staff have already returned to the office or plan to do so in the future, we cannot ignore the possibility of lasting remote or hybrid work in the future. Remote working is here to stay in some form or other.

Organizations that have already implemented AP/AR automation (accounts payable and accounts receivable) have experienced a seamless transition from office to home working that has not compromised operations or IT resources. Aside from facilitating remote work, automated AP operations also speeds up processing, eradicates outdated manual data entry, increases accuracy, and removes the need to physically “touch” invoices. It is no wonder that so many companies have made the switch.

Automation in AP has been a top priority for some time now; however, the Covid-19 pandemic appears to have progressed this trend with a recent KPMG report stating that “80% of CEOs globally have seen the digital transformation of their businesses accelerate over the past few months.”

If you have not already implemented accounts payable automation in your organization, you need to ensure it is a top priority for 2022. Here are 7 reasons why:

Why you Need AP Automation in 2022

1. Reduced Costs

One of the biggest priorities for organizations has been reducing costs, in order to minimize the financial impact of the pandemic. Companies often overlook how much legacy methods are costing their business every year. If your accounts payable team is still processing invoices manually, you may be interested to know that companies that have already made the switch to automation are, on average, paying 80% less per invoice.

According to research, the manual processing of a single invoice can amount to $10.89 or more, while AP teams that have automated processes are paying 80% less. If you are processing thousands of invoices annually, you can imagine just how much you are losing out.

In addition, cash flow management has been a major area of focus, as organizations attempt to mitigate the effects of supply chain disruptions. One such way to improve cash flow is through capturing early payment discounts. Using manual methods, you might be surprised to learn just how many early payment opportunities slip by.

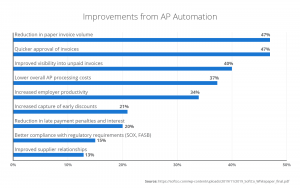

Companies taking advantage of early payment discounts have increased but there is still substantial room for improvement as only 31% of companies took advantage of vendor discounts. An automated AP solution will significantly reduce the time taken to process an invoice and thus greatly improve your chances of availing of early payment discounts. Additionally, a system that includes comprehensive accounts payable reporting will provide visibility over vendors providing favorable payment terms and how often they are availed of.

2. Shorter Processing Times

Companies with slow invoice processing times tend to struggle to reduce costs within accounts payable. This is largely due to the missed opportunities around early payment discounts or, even worse, the penalty fines that have to be paid to vendors when payment deadlines are missed.

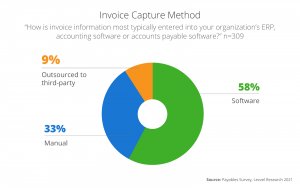

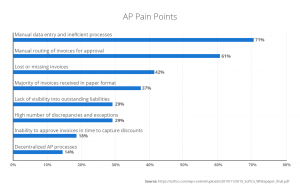

Levvel Research has shown that manual routing of invoices for approval causes the biggest slowdown in the AP process. Remote working has only drawn more attention to how inefficient this process can be. With staff no longer physically interacting on a daily basis, invoices requiring approval can be left un-actioned in inboxes for several days. For AP departments still dealing with paper invoices sent directly to the office, the switch to remote working has become near impossible.

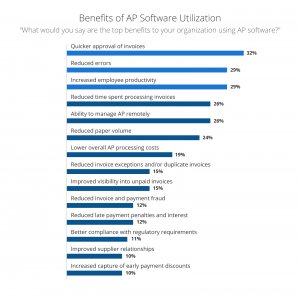

However, AP teams that implemented automated solutions in advance of the switch to remote working have experienced a seamless transition. Moreover following implementation, according to Levvel, companies saw quicker approval times, reduced errors, and increased employee productivity. This means that companies who adopted automation are not only in the position to continue their processes while working remotely, they are also optimizing the department’s time whilst doing it.

3. Reduced Human Error

Human error is bound to occur at one stage or another with manual invoice processing, with the potential for this increasing as AP staff operate from limited IT systems in their homes. As businesses attempt to scale back and prioritize the payment of only essentials, the last problem they need is costly human error.

Entering invoice data inaccurately is one of the main areas where errors occur in the AP process, leading to slowdowns in the matching process or even overpayments. An automated system will automatically scan an invoice and extract the relevant data required for matching, using powerful Machine Learning technology.

4. Stronger Business Relationships

Vendors and supply chains are regularly assessed as organizations attempt to get a handle on their cash flow. It is often perceived that procurement has a bigger role when it comes to vendor management, however, accounts payable are just as important.

Conversations surrounding deferments or the reorganization of payment dates might be taking place. It is down to AP to make sure these are honored. AP is also responsible for maintaining a strong relationship with vendors and to ensure when normal operations resume, the commercial connections built over time will still be intact.

AP teams have reported in a Levvel survey that lost or missing invoices are a significant problem for the department. Late payments can fracture relationships with vendors, particularly if you have agreed to deferment dates and your vendors are going through a challenging period themselves.

By implementing automated AP operations that also include a vendor portal, invoices can be submitted directly into the system by your vendors and picked up by AP staff regardless of their location, ensuring that no invoices go missing.

If vendors need to query the payment of an invoice or view the status of an invoice, they can also do this directly through the portal. This removes the possibility of vendors submitting the same invoice twice, which can often lead to duplicate payments. The added visibility and communication also enhances relations with vendors.

5. Greater Compliance

Compliance has never been more important for organizations with 87% of corporate practitioners indicating an increase in threat level from fraud. Manual processes run the risk of data breaches, as there is limited control over access, storage, and sharing of private information.

Automating accounts payable allows users to restrict access to sensitive information and store documents, invoices, and contracts safely in accordance with data regulations. A survey conducted by Strategic Treasurer said 90% felt accounts payable was the most susceptible department to fraudulent attacks.

An automated AP system that also incorporates vendor management ensures that vendors provide all necessary compliance documents at the time of onboarding and tracks ongoing compliance obligations thereafter.

6. Full Control and Visibility

Every organization needs to have full visibility into operations. The pandemic and economic environment make this an absolute necessity. Automation gives greater visibility into the accounts payable process as management can assess the company’s spending and financial health. Companies that use automation have the advantage of having everything on one platform, providing an overview of costs, unpaid invoices, and outstanding liabilities. According to Levvel, 40% of respondents saw improved visibility in their outstanding invoices with automated AP operations.

Management also benefits from high-level reports on vendor performance, cash flow, and working capital by having an automated accounts payable system, which is significant given the current climate. They also have visibility into their employees’ day-to-day even if they are working remotely, which reduces the need to set tasks and follow up with individual employees to gain an insight into their projects and workload. 34% of organizations also see an increase in employee productivity post automation.

7. Seamless Integration

If you are currently switching between different applications and manually entering the same data into multiple systems, there is another way. Automation looks after those dull and unproductive tasks to free-up staff to focus on high-value responsibilities.

A word of caution – make sure you choose a system that avoids double-entry of data when it comes to payment of invoices. You may require full integration between your AP system and ERP system, enabling approved invoices to be automatically routed to your ERP system ready for payment. Alternatively, you may look for an AP system that offers a file output of your approved invoices that can then be uploaded to your ERP system, depending on your needs. To learn more about integrations, click here.

Conclusion

If the switch to remote working has proven difficult for your AP team, now is the time to join the many organizations that have already implemented an automated accounts payable solution. A successful AP automation project reduces processing times, removes human error, improves vendor relations, and increases compliance, all of which reduce costs. As finance leaders continue to digitally transform operations, a switch to AP automation in 2022 should be the number one priority for AP teams still operating manual processes.